Vol. 81/No. 2 January 9, 2017

(feature article)

Roots of today’s world capitalist economic crisis

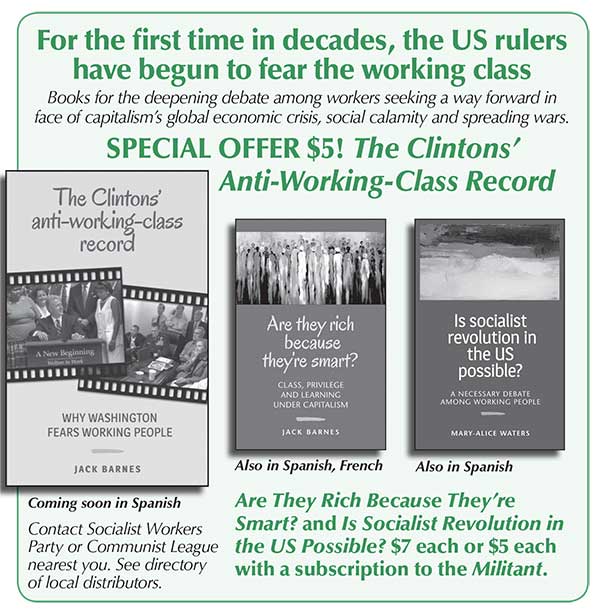

Below is an excerpt from The Clintons’ Anti-Working-Class Record: Why Washington Fears Working People, by Jack Barnes, national secretary of the Socialist Workers Party. It is from the chapter “Roots of the 2008 World Financial Crisis,” written in May of that year. Copyright © 2016 by Pathfinder Press. Reprinted by permission.

Since the mid-1970s, when capitalism was hit with its first worldwide recession since World War II, the employing class has had diminishing room for substantial economic and social concessions to working people. [Bill] Clinton’s job was to distance the Democratic Party from the “New Deal”–style social welfare programs many workers identified with that party. It had claimed credit for them ever since rising labor battles in the 1930s wrenched concessions from Franklin D. Roosevelt’s administration during the Great Depression. From the New Deal through Lyndon Johnson’s “Great Society” in the mid-1960s, those programs had been the glue that held together the diverse Democratic Party coalition.

While draping itself in the Democrats’ “progressive” mantle, the Clinton administration set out to change the party’s complexion to such a degree that what had previously been its “moderate center” would become its broad majority and redefine what a liberal Democrat is. …

The Clinton administration also accelerated steps by the US rulers to try to counteract the declining rate of profit and the employers’ “inadequate” returns on capital expenditures. The goal was to “encourage” the capitalists to expand industrial plant and equipment and employ growing numbers of workers in production. To that end, the administration and Congress adopted legislation that, along with other White House measures, helped the employing class erect the enormous edifice of household, real estate, corporate, and government debt, and its accompanying array of derivatives, that began to unravel with the first signs of a world financial crisis in 2007 and its acceleration early this year.

Nobody knows, nor can know, how this financial crisis will unfold. But it’s not the result of “mistaken policies.” It is a product of the workings of the laws of capitalism itself. It’s a consequence, not a cause, of finance capital’s development. The propertied US families have no choice but to engage in their debt-propelled course. …

By the end of 2007, the outstanding value worldwide for such derivatives reached the previously unimaginable total of $596 trillion. In 2007 alone the single most “popular” variety of these massively leveraged bets actually doubled — so-called credit-default swaps, a form of supposed “insurance” against nonpayment of these same very risky deals. But as the direction of financial markets shifted at an accelerating pace in late 2007, the antidote became the poison.

Over the two decades since the 1987 stock market crash struck terror in the US rulers’ hearts, they have maneuvered to avert a deep economic slump. As they’ve sought to hold down prices and interest rates, while at the same time spending billions on wars from Iraq to Yugoslavia to Afghanistan, their mounting debt has increasingly been bankrolled by governments and wealthy individuals around the world. Excluding Treasury bonds held by the Federal Reserve bank, more than half of these bonds — the US government’s major credit instrument — are now, for the first time in history, held by these foreign entities.

The capitalists in China, who increasingly dominate the regime there, have been especially eager lenders to Washington and Wall Street. As of December 2007 they had bought up nearly $500 billion in US Treasury bonds — more than 20 percent of all such certificates outstanding worldwide, within a few months surpassing Japan as the number-one holder.

The Beijing regime’s policy is to help keep the US dollar strong and maintain a competitive edge for Chinese manufactured goods in world markets. They are trading away improvements in the wages, social welfare, and living conditions of hundreds of millions of workers and peasants in China in order to boost export revenues that line the pockets of rising propertied layers and the privileged state and party bureaucracy in the new capitalist mandarinate. They’ve done so at the same time they are intensifying exploitation of toilers across Africa, Asia, and other parts of the world to accumulate capital in China.

By the end of 2008 US imperialism will have spent some $900 billion on its wars in Afghanistan and Iraq, and the figures will head well into the trillions as the bloodletting continues. On top of that, the US rulers have waved the bloody shirt of 9/11 again and again in order to nearly double their overall war spending (they call it a “defense” budget) — from $308 billion in 2001 to nearly $600 billion in 2008. How are these wars being paid for? They’re financed by debt.

In fact, for the first time in American history, the US ruling class is waging a major multifront, multiyear war without patriotic appeals for “sacrifice”—without drastically cutting back government domestic spending, imposing steep new taxes, or pressing “victory” bonds on working people and the middle classes. This time, at least for a while, the “victory” bonds are being bought by capitalists and other wealthy individuals and institutions in the United States, Japan, China, and many other places.

Related articles:

World capitalism’s slow-burning depression

Front page (for this issue) | Home | Text-version home