Vol. 80/No. 3 January 25, 2016

(front page)

Workers face depression as capitalist crisis grows

Industrial production contracts, layoffs spread

Propertied families in the U.S., who for decades have seen little percentage in investing in plant and production, where profit rates were falling, have been ploughing their money into stocks, bonds and other paper in search of higher returns, boosting stock prices on the market to levels today that have no relation to the real economy.

“At the peak of every speculative bubble, there are always those who have persistently embraced the story that gave the bubble its impetus in the first place,” investment adviser John Hussman wrote in his newsletter Jan. 4, entitled “The Next Big Short: The Third Crest of a Rolling Tsunami.”

The “story” in 2007 was that the bubble in speculative paper wrapped around sub-prime housing loans would never burst. Today the “story” has been that stocks and investments in China, Brazil and other “emerging markets” will just keep growing.

But the spreading industrial contraction and crisis in “emerging market” economies indicate the jig is up. Those hit hardest are workers and farmers, who face grinding depression conditions.

“Coal producers around the U.S. are slashing production, as low prices make mining unprofitable,” industry outlet oilprice.com said in October, “with Central Appalachia reporting the sharpest cutbacks.”

Patriot and Arch Coal — the two largest U.S. coal companies — have declared bankruptcy, along with Alpha Natural Resources. Patriot’s Hobet Surface Mine and Samples Mine cut production 43 percent in the third quarter.

Faced with a glut on the world market, steel bosses are shuttering mills, laying off thousands of workers. U.S. Steel is idling its Granite Steel Works in Illinois, putting 2,000 steelworkers on the street.

More than half of the 11 iron ore mining operations on the upper Minnesota Iron Range are closed. Shutdowns began in March and unemployment checks are running out. The Mesabi Nugget iron plant and Mining Resources concentrate plant say they are closing for the next two years.

The ripple effect means thousands more, from support workers to waitresses, face shutdowns and job losses.

A quarter of a million oil workers have lost their jobs worldwide as overproduction has pushed prices through the floor. A year ago, the business press gushed with stories about the shale oil boom in North Dakota. Today, “in North Dakota, oil field equipment sits idle,” KX4-TV reported Jan. 4. “The rough necks laid off, they dump their campers in Tom Novak’s junkyard on their way out of town.”

The Wall Street Journal predicted Jan. 11 that a third of all U.S. oil producers could end up in bankruptcy.

Cuts in oil and coal production and the manufacturing depression mean rail bosses are slashing jobs and cutting routes. “Carloads have declined more than 5 percent in each of the past 11 weeks,” Bank of America reported this month, calling it a “substantial and sustained weakness” not seen since 2009.

CSX railroad announced it is laying off 277 workers at the Tennessee Erwin Yard and another 180 at the Kentucky Corbin Yard. Union Pacific has put more than 2,700 rail workers on furlough, saying transport of agricultural and industrial products, chemicals, intermodal trade and coal has tumbled.

Canadian rail volume is down 15 percent and Mexican volume 20 percent.

Plants that build rail cars are looking at layoffs. “I don’t know when, and I don’t know how big, but you don’t need a crystal ball to figure out that orders are down,” Scott Slawson, president of the United Electrical Workers union local at GE Transportation, told the Erie, Pennsylvania, Times-News.

Workers in the United Kingdom face similar pressures, as “almost every part of the manufacturing sector suffered declining production,” the Financial Times reported Jan. 12.

In Brazil authorities cancelled the annual carnival parades because the country faces “what is expected to be the worst recession since at least the 1930s,” the Times noted.

Capitalist bosses and their hired advisers in government and the media have no answers. Years of government stimulus measures — from seven years of zero interest rates, slightly increased by the Federal Reserve in December, to “quantitative easing” money-printing schemes where the Fed bought hundreds of billions of dollars of government bonds and largely worthless mortgage-backed securities from banks — have failed to kick-start investment in production and jobs.

Instead, capitalist investors continue to speculate on stocks, junk bonds and other commercial paper here and abroad. “To say that the financial markets are presently at a speculative extreme is an understatement,” writes Hussman.

Production slows in China

The economy of China — looked to in recent years by capitalists around the globe as a “miracle” engine of world growth — is running out of steam. Manufacturing there declined for the 10th straight month in December.China, which bought more than $2 trillion of goods and services from the rest of the world every year to fuel its export economy, has now had a decline in imports every month since October 2014, according to government data. Directly impacted are partners throughout Southeast Asia, including Japan, South Korea and Australia; “emerging market” regimes from South Africa to Brazil; Germany, the leading economic power in the eurozone that exports large amounts of machinery to China; and mining and manufacturing in the U.S.

In response to plant shutdowns and layoffs, Chinese workers’ strikes and protests are on the rise — nearly 2,800 last year, double those in 2014, according to the China Labour Bulletin — and workers’ resistance has won higher pay.

The capitalist media, pointing to the U.S. Labor Department’s report that jobs increased by 292,000 in December, claims U.S. capitalism is on the road toward full employment and recovery.

The official U.S. unemployment rate for December was unchanged from the previous month at 5 percent. But millions of other workers can’t get full-time jobs. This includes more than 6 million forced to accept just part-time hours — 20 percent higher than before the onset of the 2008 economic downturn.

The December statistics include thousands of temporary retail workers hired — and now fired — in what turned out to be a lackluster holiday season.

The government has eliminated millions of so-called “discouraged” workers from the workforce count. The labor force participation rate remains at a nearly 40-year low.

“Anyone claiming that America’s economy is in decline is peddling fiction,” said Obama in his State of the Union speech Jan. 12, claiming that a “manufacturing surge” has “created nearly 900,000 new jobs in the past six years.”

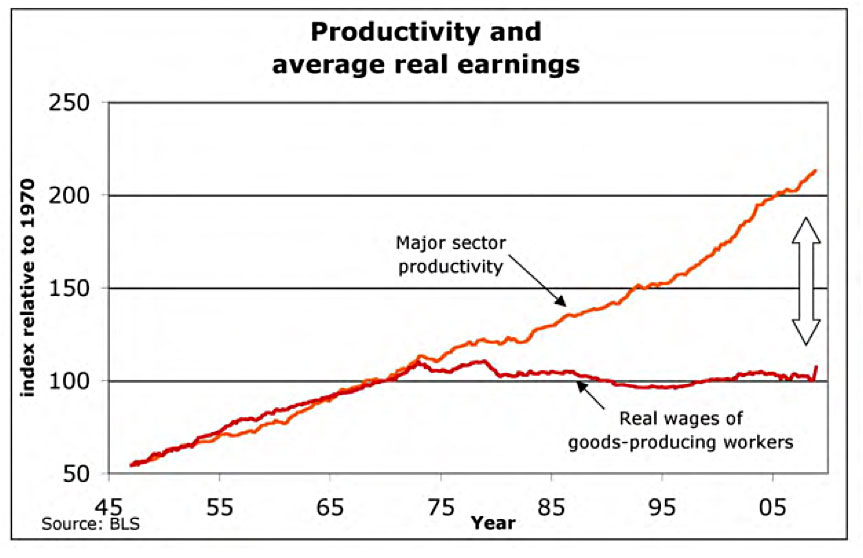

Real wages for production workers remain at their 1970 level. But production per worker has more than doubled, with more goods being created by fewer workers through boss-imposed speedup and disregard for safety.

Warehouse bosses are introducing new bar-code reading devices to boost the number of scans — already about 3,000 a day — that workers do in pick-and-pack operations each shift. Warehouse workers have among the highest rates of occupation injuries and illnesses in private-sector industries, the Labor Department reports.

Using new scanners that eliminate having to push buttons shaves off half a second per scan, James Bonner, general manager of Exel Logistics, told the Journal. That speeds up picking rates by 10 to 20 percent over a 7.5 hour shift.

Front page (for this issue) | Home | Text-version home